Title loan predatory lending prevention is a growing concern as vulnerable individuals fall victim to high-interest rates, hidden fees, and deceptive marketing. Lenders target them with short-term secured loans like motorcycle title loans, lacking proper credit checks or income verification. Current regulations have gaps, especially in protecting borrowers from high-interest cycles. Stricter rules are needed, including clear terms, flexible repayment schedules, interest rate limits, and dispute resolution mechanisms to prevent debt traps and safeguard consumer rights.

In recent years, borrowers have increasingly demanded stronger title loan predatory lending prevention rules. Title loans, a form of secured debt using vehicle titles as collateral, have been linked to predatory lending patterns due to high-interest rates and aggressive collection practices. This article delves into the understanding of these lending practices, highlights current regulations with significant gaps, and advocates for enhanced safeguards to protect borrowers’ rights in the title loan market.

- Understanding Title Loan Predatory Lending Patterns

- Current Regulations and Gaps in Title Loan Protection

- Strengthening Rules to Safeguard Borrowers' Rights

Understanding Title Loan Predatory Lending Patterns

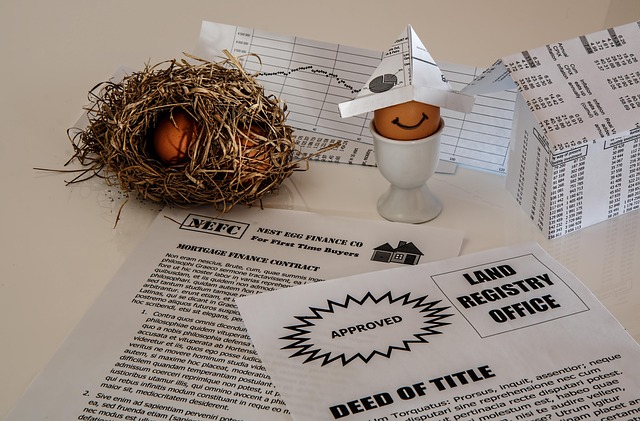

Title loan predatory lending prevention is a critical issue that has been gaining attention due to the increasing number of borrowers falling victim to unfair and aggressive lending practices. These patterns often involve high-interest rates, hidden fees, and deceptive marketing strategies aimed at vulnerable individuals in need of quick cash. Lenders who engage in such activities target those with limited financial resources, including low-income earners and people facing emergency expenses, by offering short-term loans secured against their vehicle titles.

Motorcycle Title Loans, for instance, have become a popular yet treacherous option for borrowers seeking immediate relief. With minimal credit checks or verification of income, these loans can trap individuals in a cycle of debt. The absence of stringent regulations and oversight allows predatory lenders to exploit borrowers’ desperation, leading to situations where they are unable to repay the loan on time, resulting in the repossession of their vehicle. Such practices perpetuate a cycle of poverty and hinder financial stability, underscoring the urgent need for stronger Title Loan Predatory Lending Prevention rules.

Current Regulations and Gaps in Title Loan Protection

The current regulatory landscape surrounding title loan predatory lending prevention is a complex web with significant gaps. While federal laws like the Truth in Lending Act (TILA) provide some safeguards, their enforcement and reach are often limited when it comes to short-term, high-interest loans facilitated through titles. In many cases, these regulations fail to address the intricate strategies employed by lenders to trap borrowers in cycles of debt.

One key gap lies in the lack of comprehensive guidelines on transparent and fair repayment options. Borrowers seeking fast cash, like those looking for Houston title loans, often face obscure terms and conditions that make it difficult to escape loan obligations without severe financial repercussions. This situation demands stronger regulations that mandate clear, understandable terms, including flexible repayment schedules, to protect borrowers from predatory practices aimed at prolonging debt periods and amplifying interest payments.

Strengthening Rules to Safeguard Borrowers' Rights

In an effort to protect consumers from unfair practices, there is a growing call for stricter regulations surrounding title loan predatory lending. These rules aim to strengthen borrowers’ rights and prevent lenders from taking advantage of individuals in desperate financial situations. By implementing more robust measures, regulators can ensure that San Antonio Loans provide a fair and transparent solution to short-term funding needs, without trapping borrowers in cycles of debt.

With quick funding often being a selling point for title loans, it’s crucial to strike a balance between accessibility and protection. While same-day funding can be a lifeline for some, robust prevention rules will safeguard individuals from hasty decisions that could lead to long-term financial strain. Such regulations should include clear disclosure requirements, limits on interest rates, and enforceable mechanisms to resolve disputes, fostering an environment where borrowers understand the terms of their loans and are empowered to make informed choices.

In light of the above discussions, it’s clear that strengthening title loan predatory lending prevention rules is paramount to protecting borrowers. By addressing the current gaps in regulations and adopting more robust measures, we can create a fairer and safer lending environment. Such enhancements will empower borrowers, foster trust, and ensure that title loans serve as a beneficial financial tool rather than a source of exploitation.